Modern finance teams increasingly rely on automated workflows to eliminate duplicate entries, reduce manual reconciliations, and maintain accurate financial records across systems. NetSuite Xero integration enables organizations to synchronize invoices, bills, payroll data, journal entries, contacts, and financial accounts between both platforms without relying on manual import/export processes. By connecting two powerful accounting ecosystems, enterprises can streamline multi-entity operations, accelerate financial close cycles, and maintain consistent data across payroll, AR/AP, and general ledger workflows.

What is NetSuite Xero Integration?

NetSuite Xero integration refers to the automated or semi-automated synchronization of financial and operational data between NetSuite (ERP) and Xero (accounting/payroll). This integration is typically implemented using iPaaS platforms like Zapier, Clarity, Beehexa, Hexasync, or custom API scripting through SuiteTalk and Xero’s REST APIs.

At its core, the integration ensures that data such as invoices, bills, earnings, timesheets, contacts, payroll components, chart-of-account mappings, and journal entries flow smoothly between systems, reducing data silos and enabling unified financial reporting.

NetSuite Xero integration syncs financial data like invoices, bills, payroll, and journal entries between NetSuite and Xero using automation tools or APIs to eliminate manual data entry and maintain accounting accuracy.

Business Value of NetSuite Xero Data Synchronization

For organizations running NetSuite for ERP and Xero for payroll or regional accounting, the integration delivers significant operational and strategic value:

1. Eliminates Manual Dual Data Entry

Teams no longer need to re-enter the same invoice, payroll, or bill in two systems. This reduces repetitive work, eliminates transcription errors, and ensures faster data availability.

2. Increases Accuracy Across AR/AP and Payroll

Financial data automatically syncs with both systems, accounts payable, receivable, payroll journals, and contact details, ensuring consistency between operational and accounting records.

3. Accelerates Month-End and Multi-Entity Close Cycles

With journal entries, payroll runs, and financial activities syncing in real time, accountants no longer wait for delayed exports or cross-system reconciliations.

4. Supports Scalable Payroll and Workforce Management

Many organizations use Xero for payroll (due to its strong HR/payroll capabilities) and NetSuite as their central ERP. Integration ensures seamless workforce, superannuation, and earnings data flow.

5. Enables Global or Multi-Entity Consolidation

When Xero is used for regional bookkeeping or payroll and NetSuite serves as the global ERP, integration supports consolidation at the group or holding company level.

Why Organisations Integrate NetSuite and Xero

Enterprises and mid-market companies frequently integrate NetSuite and Xero because:

- They migrated from Xero to NetSuite, but still want historical or regional processes connected.

- They run Xero Payroll in Australia/NZ while maintaining NetSuite as the ERP.

- They have acquired subsidiaries still using Xero.

- They need to synchronise WFM (Workforce Management) timesheets or employee data with NetSuite.

- They want centralised reporting but decentralised payroll or AP operations.

This hybrid environment is extremely common across global retail, hospitality, professional services, manufacturing, franchise networks, and SaaS organisations.

Core Use Cases and Supported Sync Flows for NetSuite Xero Integration

The strength of NetSuite Xero integration lies in its ability to automate highly repetitive financial tasks across payroll, billing, accounts payable/receivable, and general ledger operations. Whether implemented using iPaaS solutions like Zapier, Clarity, Beehexa, or through custom API development, the integration ensures that both NetSuite and Xero reflect accurate, synchronised financial data at all times.

Below are the most critical use cases, along with the specific data flows commonly automated between the two systems.

1. Payroll Integration (WFM → Xero Payroll)

Payroll is one of the most common and impactful use cases—especially for organisations using Workforce Management (WFM) or NetSuite for HR/time tracking but relying on Xero for payroll processing.

Typical Payroll Sync Flow:

Payroll workflows usually follow this path:

- Timesheets / Approved Hours

- WFM or NetSuite time data is exported to Xero.

- Includes standard hours, overtime, penalties, and allowances.

- Employee and Earnings Data

- Employee pay rates, role types, allowances, deductions, superannuation (Australia/NZ), and tax details sync into Xero Payroll.

- Employee pay rates, role types, allowances, deductions, superannuation (Australia/NZ), and tax details sync into Xero Payroll.

- Bank Account Details

- Employee banking details remain consistent across both systems.

- Employee banking details remain consistent across both systems.

- Payroll Calendar Mapping

- Pay cycles (weekly/fortnightly/monthly) sync so payroll runs align with schedules.

- Pay cycles (weekly/fortnightly/monthly) sync so payroll runs align with schedules.

Benefits:

- No double entry of hours

- Accurate, region-specific payroll compliance

- Reduced manual adjustments

- Automated payroll journals into NetSuite (if configured)

This is especially helpful in Australia and New Zealand, where Xero Payroll is widely adopted for compliant regional payroll operations.

2. Accounts Payable (AP) Synchronisation

NetSuite Xero integration supports bi-directional syncing of AP data, allowing enterprises to manage vendor bills, payments, and obligations across systems without fragmentation.

Typical AP Sync Flow:

- Vendor bills created in NetSuite → automatically push into Xero as bills.

- Bills created in Xero → sync back into NetSuite for consolidated financial reporting.

- Vendor details sync both ways (address, ABN/NZBN, email).

- Bill payments recorded in Xero → update NetSuite to maintain GL accuracy.

Business Impact:

- Avoids duplicate supplier bills

- Reduces reconciliation discrepancies

- Keeps vendor ledgers aligned across regions

- Ensures subsidiaries using Xero can still report into NetSuite accurately

3. Accounts Receivable (AR) Synchronisation

Integration also supports AR sync, enabling seamless customer billing, payment tracking, and consolidation.

Typical AR Sync Flow:

- Xero invoices → push to NetSuite as sales orders or AR invoices

- NetSuite invoices → push to Xero for regional processing

- Customer payments recorded in Xero → update corresponding transactions in NetSuite

- Customer contact information stays synced

This supports organisations that handle customer billing regionally but consolidate revenue globally under NetSuite.

4. Journal Entry Synchronisation

Journal sync is critical for organisations using Xero for payroll or AP, but NetSuite for core ERP, financial planning, or reporting.

Typical Journal Sync Flow:

- Payroll journals (earnings, tax, superannuation) → push from Xero to NetSuite

- Consolidation journals → push from Xero to NetSuite for group reporting

- Revenue allocation journals → sync from NetSuite to Xero

- Intercompany adjustments → push NetSuite → Xero for entity-level bookkeeping

Why This Matters:

- Ensures the GL in both systems stays accurate

- Supports multi-entity close

- Eliminates the risk of mismatched ledgers

- Helps maintain compliance in audited environments

This is foundational for organisations that use Xero for operational payroll but must maintain global financial integrity in NetSuite.

5. Contacts and Employee Synchronisation

Maintaining consistent vendor, customer, and staff data across systems is key to avoiding mismatches and sync failures.

Typical Records Synced:

- Customer records

- Vendor/supplier profiles

- Employee records

- Contact addresses

- Payment/bill-to details

- Tax or compliance identifiers

Why This Is Important:

- Ensures invoices go to the right accounts

- Prevents duplicate vendor/customer creation

- Avoids payroll errors due to outdated employee details

- Supports audit accuracy

This also keeps downstream integrations (WFM, AP automation platforms, CRM systems) aligned with both NetSuite and Xero.

6. Custom Triggers and Workflow Automations (via iPaaS)

One of the most powerful aspects of NetSuite Xero integration is the ability to build custom flows using middleware like Zapier, Hexasync, Beehexa, Celigo, Clarity, or Make.

Examples of Custom Automation Triggers:

- “New Xero invoice → Create NetSuite sales order.”

- “New NetSuite vendor bill → Create Xero bill automatically.”

- “Xero payment received → Mark NetSuite invoice paid.”

- “New NetSuite employee → Create Xero employee record.”

- “NetSuite journal approved → Create Xero manual journal.”

Benefits of Custom Automations:

- Tailored workflows for industry-specific processes

- Reduced manual intervention

- Automated exception handling

- Consistent master data across systems

Custom workflows are especially valuable for high-volume operations, multi-brand companies, franchise networks, and businesses running multiple sub-ledgers.

7. Multi-Entity and Multi-Region Workflows

Many organisations integrate Xero and NetSuite because they operate subsidiaries that use different systems.

For example:

- Parent company: NetSuite

- Local AU/NZ subsidiaries: Xero (due to payroll and tax compliance)

Supported Multi-Entity Scenarios:

- Xero entity → NetSuite HQ reporting

- Multiple Xero orgs → consolidated NetSuite group GL

- Regional payroll → global ERP

- Regional invoicing → global revenue management

Configuration and Setup Essentials for NetSuite Xero Integration

A successful NetSuite Xero integration requires careful preparation, role-based access, correct API credentials, and robust mapping between both systems. Because NetSuite and Xero operate using different data models and regional structures, the setup phase is critical for ensuring accurate synchronization of payroll, AR/AP, journal entries, and employee/contact records.

Below is a detailed breakdown of everything required before and during the integration setup.

1. Prerequisites: What You Need Before Integration

Before connecting NetSuite, Xero, WFM, or your iPaaS platform, specific prerequisites must be in place.

a. Role & Access Requirements

In Xero:

- Payroll Administrator or full access to Xero Payroll

- Ability to configure tracking categories

- Permission to authenticate third-party apps

In NetSuite:

- Finance Coordinator or Accountant role for posting journals

- Permission to view/create vendor bills, invoices, customers, and employees

- Administrator role (or custom role) for SuiteTalk/API

In WFM (if used):

- Payroll Admin access

- Ability to configure mapping and export preferences

b. API Keys and Integration Credentials

You will need:

- Xero API key/secret (OAuth 2.0 credentials)

- NetSuite Token-Based Authentication (TBA) keys

- iPaaS platform credentials (Zapier, Clarity, Celigo, Beehexa, Make, Hexasync, etc.)

Missing or incorrect credentials are the most common cause of failed integration attempts.

2. Mapping Essentials: Making Both Systems Speak the Same Language

NetSuite and Xero have different data structures, so mapping is essential.

Incorrect mapping leads to mismatches, duplicate entries, or rejected records.

a. Location Mapping → Xero Tracking Categories

WFM or NetSuite locations should map to Xero tracking categories to ensure consistent reporting.

Example:

- NetSuite Location: “Sydney Warehouse” → Xero Tracking Category: “Region: Sydney”

- NetSuite Location: “Auckland Office” → Xero Tracking Category: “Country: NZ”

b. Staff and Employee Mapping

Each staff member must link to a unique Xero employee record.

Mapping includes:

- Employee ID

- Bank account

- Pay rate/earnings

- Superannuation funds (AU)

- Tax codes

If employee IDs or emails differ between systems, duplicates will occur.

c. Payroll Components Mapping

For WFM or NetSuite payroll data to sync correctly into Xero Payroll, the following must match:

- Wage categories

- Allowance types

- Penalty rates

- Superannuation accounts

- Bank accounts

- Leave categories

- Payroll calendars

Misaligned payroll components cause failed payroll exports.

d. GL / Accounts Mapping

This is one of the most important steps.

To sync journal entries, invoices, or bills, you must match:

- NetSuite Chart of Accounts → Xero Chart of Accounts

- Account codes

- Tax codes

- Subsidiary-level classifications

- Cost centers

3. Linking Steps for WFM → Xero (Payroll-Specific Setup)

If the organization uses WFM or NetSuite for time tracking and Xero for payroll, these linking steps are mandatory.

Step-by-Step Configuration:

- Set Up Xero Tracking Categories

- Create tracking categories for locations, departments, or cost centers.

- Create tracking categories for locations, departments, or cost centers.

- Map WFM Locations to Xero Tracking Options

- Ensure each WFM location has a corresponding Xero category.

- Ensure each WFM location has a corresponding Xero category.

- Map WFM Staff to Xero Employees

- Use unique identifiers such as email or employee ID.

- Use unique identifiers such as email or employee ID.

- Map Wage Categories, Super Funds, Allowances

- Ensure every payroll earnings type has a corresponding Xero payroll item.

- Ensure every payroll earnings type has a corresponding Xero payroll item.

- Map Payroll Calendar

- Weekly/fortnightly/monthly cycles must match exactly.

- Weekly/fortnightly/monthly cycles must match exactly.

- Configure Timesheet Export Preferences

- Choose whether timesheets export automatically upon approval or after batch approval.

- Choose whether timesheets export automatically upon approval or after batch approval.

- Authenticate WFM / NetSuite to Xero

- OAuth-based authentication links the systems.

Outcome:

Once these steps are complete, timesheets and payroll components can flow directly into Xero Payroll for accurate and compliant payroll processing.

4. iPaaS Setup

For broader financial synchronization, organizations typically use iPaaS.

Core Setup Steps:

- Install the connector from your preferred platform.

- Authenticate NetSuite and Xero using OAuth (Xero) and TBA (NetSuite).

- Select triggers (e.g., “new invoice in Xero,” “approved bill in NetSuite”).

- Define actions (e.g., “create NetSuite sales order,” “post Xero bill”).

- Map fields between source and destination.

- Enable batch or real-time sync, depending on volume.

- Test workflows in the sandbox before activating live sync.

Why iPaaS Is Preferred:

- Faster to deploy

- Supports two-way sync

- Offers prebuilt workflows

- Provides better monitoring and error handling

- Reduces dependency on engineering resources

5. Custom API/Script-Based Integration

Some enterprises choose custom scripting for full control.

Typical Technical Tools Used:

- NetSuite SuiteTalk REST/SOAP API

- Xero REST API

- Custom middleware built in Node.js, Python, or C#

- AWS Lambda or Azure Functions for scheduled sync

- Webhooks from Xero for real-time triggers

When Custom Integration Is Ideal:

- High transaction volume

- Deep customization required

- Multi-layer approval workflows

- Industry-specific processes

- Integration with additional systems like WFM, CRM, and POS

Benefits:

- Maximum flexibility

- Unlimited mapping options

- End-to-end control

- Highly scalable for complex enterprises

Data Model and Field Mapping in NetSuite Xero Integration

Accurate field mapping is the backbone of any successful NetSuite Xero integration. Because NetSuite and Xero use fundamentally different data structures for financial operations, payroll, contacts, and journal entries, mapping ensures that each exported or imported record lands in the correct target field without duplication or distortion.

This section outlines the core data flows, the mapping logic between fields, and best practices for preventing mismatches across systems.

1. How NetSuite and Xero Data Models Differ

NetSuite operates as a full ERP with deep support for:

- Multi-entity accounting

- Subsidiary structure

- Segmented GL (class, department, location)

- Intercompany transactions

- Advanced revenue management

- Complete inventory & order management

Xero, on the other hand, is streamlined for:

- Local/regional accounting

- Payroll processing

- Basic AR/AP

- Bank reconciliation

- Tracking categories (similar to NetSuite’s departments/locations but more limited)

These differences make mapping essential, particularly in multi-entity environments.

2. Core Mapping Table

Below is a clear table showing typical mapped fields between systems:

Source | Target | Example Fields / Notes |

WFM/NetSuite | Xero Payroll | Employee info, hours, earnings, superannuation, bank details |

NetSuite | Xero | Accounts, invoices, journal entries, customer data |

Xero | NetSuite | Bills, payments, contacts, payroll journals |

Location | Tracking Category | NetSuite Locations → Xero Tracking Categories |

3. Employee and Payroll Mapping (WFM/NetSuite → Xero Payroll)

Payroll mapping is often the most sensitive and error-prone, so accuracy is crucial.

Employee Fields Mapped:

- Employee ID (unique identifier)

- Full name

- Email address

- Bank account number

- Pay template

- Tax file number / national ID

- Superannuation or pension funds

- Leave balances (optional)

Earnings & Payroll Components Mapped:

- Regular hours

- Overtime

- Penalty rates

- Allowances

- Bonuses

- Deductions

- Employer contributions

Why Unique Identifiers Matter:

Without consistent, unique fields (email or employee ID), you risk:

- Duplicate employee creation

- Failed payroll exports

- Journal posting mismatches

Mapping must be configured before payroll sync is enabled.

4. Accounts Payable Mapping (Bills and Vendor Records)

Vendor and AP data must align cleanly for accurate expense reporting.

Vendor Fields Mapped:

- Vendor name

- Vendor email

- Billing address

- Payment terms

- Tax ID

- Contact person(s)

- ABN/NZBN (Australia/New Zealand markets)

Bill Fields Mapped:

- Bill number

- Bill date

- Due date

- GL account

- Tax amount / GST / VAT

- Line item description

- Tracking category/department

- Payment status

Two-Way AP Mapping Supports:

- NetSuite → Xero bills (for regional processing)

- Xero → NetSuite bills (for global reporting)

5. Accounts Receivable Mapping (Customers, Invoices, Payments)

AR mapping is vital for revenue accuracy and proper consolidation.

Customer Fields Mapped:

- Legal name

- Contact address

- Payment terms

- Tracking category/department

- Customer ID

Invoice Fields Mapped:

- Invoice number

- Invoice date

- Due date

- Items or descriptions

- GL accounts

- Tax rules

- Totals (exclusive or inclusive of tax)

Payment Mapping:

Payments recorded in Xero must update NetSuite AR for reconciliation and cash reporting.

6. Journal Entry Mapping (GL Synchronization)

Since NetSuite and Xero structure journals differently, mapping must be deliberate.

Journal Entry Fields Mapped:

- Journal date

- Posting period

- Debit and credit lines

- GL account

- Location/department/class

- Currency

- Tax details (if applicable)

- Memo or reference

Use Case Examples:

- Xero payroll journals → NetSuite GL

- NetSuite revenue journals → Xero entity GL

- Consolidation journals → parent-level NetSuite instance

7. Contacts Mapping (Vendors, Customers, Staff)

Contacts often sit at the center of multiple workflows—AR, AP, payroll.

Mapped Fields Include:

- Name

- Contact email

- Phone

- Address

- Tax registration

- Category or type (vendor/customer/employee)

Mapping ensures that both systems maintain consistent master data.

8. Inventory & SKU Mapping

Although not common in all use cases, some organizations sync SKUs.

Mapped SKU Fields:

- SKU / Item ID

- Item name

- Description

- Price

- Tax settings

- Tracking category

- Inventory account

This is most common in eCommerce or retail environments, integrating multiple systems.

9. Preventing Duplicate Records

Duplicate creation is the #1 issue in poorly mapped workflows.

How to Prevent Duplicates:

- Use consistent employee IDs

- Use consistent vendor/customer names

- Ensure the email is matched as a unique key

- Maintain synchronized tax codes

- Use a mapping table or cross-reference spreadsheet

- Validate mappings in the sandbox first

10. Recommended Mapping Governance

Enterprises should maintain a mapping repository that includes:

- Master list of mapped fields

- GL mapping table

- Tax mapping table

- Payroll component mapping

- Tracking category mapping

- Unique identifier registry

- Change management documentation

This ensures that changes in one system do not break sync in the other.

Automation and Integration Options for NetSuite Xero Integration

To implement NetSuite Xero integration effectively, organizations can choose from three primary integration paths: native connectors, third-party iPaaS platforms, and custom API-based integrations. Each option serves different business needs, ranging from simple payroll syncs to advanced multi-entity financial automation.

This section explains each option in depth and helps you understand which approach best fits your operational and technical environment.

1. Native Connectors (WFM → Xero Payroll)

While NetSuite and Xero do not provide a direct native connector between each other, the most common native linkage happens between:

- Workforce Management (WFM) systems → Xero Payroll

- HR/time-tracking systems → Xero Payroll

These tools often integrate with NetSuite for time tracking or HR data while simultaneously providing out-of-the-box connections to Xero for payroll operations.

Native Payroll Connector Capabilities:

- Sync approved hours/timesheets

- Push employee updates into Xero

- Align payroll calendars

- Sync bank account numbers

- Map payroll categories (earnings, super, allowances)

- Generate payroll journals

- Support for region-specific compliance (especially AU/NZ)

Why Native Connectors Are Preferred for Payroll:

- Faster setup

- Minimal mapping required

- Highly stable and compliant

- Designed specifically for payroll workflows

- Reduces reliance on external iPaaS or developers

This is the most common setup for organizations that use NetSuite for ERP reporting and Xero purely for payroll.

2. Third-Party iPaaS Platforms (Zapier, Celigo, Beehexa, Hexasync, Clarity, Make.com)

For enterprise-grade integrations, third-party iPaaS platforms offer the most flexibility and scalability.

Common iPaaS Tools for NetSuite–Xero Integration:

- Zapier (simple workflows, ideal for small to medium business triggers)

- Clarity Ventures (deep ERP integrations)

- Beehexa / Hexasync (high-volume, multi-entity financial automations)

- Celigo (enterprise-grade, strong in the NetSuite ecosystem)

- Make.com (flexible builder for API workflows)

Key Capabilities of iPaaS Solutions:

a. Prebuilt Recipes (Out-of-the-Box Workflows)

iPaaS tools provide ready-made workflow templates. Examples:

- “New Xero invoice → Create NetSuite invoice”

- “New NetSuite vendor bill → Create Xero bill”

- “Xero payment received → Update NetSuite AR”

- “NetSuite journal approved → Create Xero manual journal”

These save weeks of development effort.

b. Drag-and-Drop Workflow Builder

Non-technical users can create workflows without writing code.

You can define:

- Triggers

- Conditions

- Filters

- Mappings

- Actions

- Loops

- Error handlers

This helps finance teams build and adjust workflows independently.

c. Advanced Field Mapping

iPaaS platforms offer detailed field-mapping engines:

- GL accounts

- Tax fields

- Departments/locations/tracking categories

- Employee identifiers

- Invoice line items

- Custom fields

This is essential for complex, multi-entity financial environments.

d. Batch Sync & Real-Time Sync Options

You can configure sync frequency based on business needs:

- Real-time (instant update)

- Scheduled (hourly/daily)

- Batch (nightly exports)

Batch sync is useful for organizations with high transaction volumes across multiple entities.

e. Error Handling and Reprocessing Tools

iPaaS solutions include:

- Retry queues

- Failed item logs

- Batch-level error reports

- Alerts and notifications

- Re-run failed tasks

This dramatically reduces manual troubleshooting.

When iPaaS Is Ideal:

- You need two-way sync

- You have multiple workflows (AR, AP, payroll, journals)

- Your organization operates multiple Xero accounts

- You require centralized monitoring

- You want scalability without custom engineering overhead

3. Custom API or Script-Based Integration (Full Control, Maximum Flexibility)

For organizations with unique workflows, high volumes, or strict compliance, custom integrations provide total control.

Technical Tools Commonly Used:

- NetSuite SuiteTalk REST/SOAP API

- NetSuite SuiteScript 2.x

- Xero REST API (OAuth 2.0)

- Webhook listeners for real-time triggers

- AWS Lambda / Azure Functions for microservices

- Node.js / Python / C# middleware

Capabilities of Custom Integrations:

- Multi-level approval workflows

- Complex conditional logic (e.g., mapping by region/entity)

- Custom record types (NetSuite)

- Script-based error handling

- High-volume batch processing

- Custom logging dashboards

- Integration with additional systems (WFM, CRM, POS)

Enterprises often choose this path when off-the-shelf tools cannot handle scale or regulatory needs.

Where Custom API Integrations Excels:

- Unique payroll structures

- Franchise or multi-brand networks

- High-volume AR/AP invoicing

- Multi-country tax rules

- Complex journal structures

- Enterprise compliance requirements

- Intercompany workflows

4. Choosing the Right Integration Method: Strategic Guidance

Choose Native Connectors If:

- You only need payroll + timesheet sync

- You use WFM with Xero Payroll

- You want the fastest setup

Choose iPaaS if:

- You need AR, AP, payroll, and journal syncing

- You manage multiple entities

- You want minimal engineering effort

- You need strong error-handling capabilities

Choose Custom Integration If:

- You require advanced routing rules

- You process high-volume transactions

- You need deep customization

- You use Xero regionally, but NetSuite globally

- You want fine-grained control over the GL

Error Handling and Reconciliation in NetSuite Xero Integration

Even the most robust NetSuite Xero integration workflows require systematic error handling, reconciliation mechanisms, and audit-ready logging. Because NetSuite and Xero differ in their financial architecture, mismatches can occur during sync operations. Effective reconciliation ensures data accuracy, prevents duplicates, maintains compliance, and allows finance teams to detect anomalies quickly.

This section outlines how errors occur, how the systems manage them, and how teams should resolve issues during ongoing integration cycles.

1. Common Causes of Sync Errors in NetSuite and Xero

Errors generally occur due to mismatched mapping, missing data, API failures, or authentication issues.

Most Frequent Error Sources:

- Unmapped accounts

- The GL account exists in one system but not the other.

- Missing tracking categories or locations

- Common during payroll or bill sync.

- Employee mismatch

- Duplicate employees or missing identifiers (ID/email).

- Incorrect tax mapping

- GST/VAT/tax codes mismatch between systems.

- API rate limits

- Especially during high-volume syncs.

- Authentication failures (OAuth expiry, MFA resets)

- Unapproved transactions

- Bills or invoices have not been approved yet in the source system.

- Date format conflicts

- Time zones or date field formatting differences.

- Duplicate vendor/customer records

- Locked periods or restricted GL posting

- NetSuite often restricts posting in closed periods.

2. Error Logging: Visibility Into Sync Failures

Both systems, especially when integrated through iPaaS or custom API, maintain detailed logs.

Error Logs Typically Contain:

- Timestamp

- Source system

- Target system

- Failure reason

- Raw payload

- Record ID

- User who triggered sync

- Recommended action

Where Logs Are Located:

- iPaaS dashboard (Zapier, Beehexa, Celigo, Hexasync)

- NetSuite “Integration Logs” tab

- Xero “Connected Apps” activity tab

- Custom API logs (AWS CloudWatch, Datadog, console logs)

3. Error Correction Workflows

When an error occurs, the integration system typically stops that record from syncing further until corrected.

Step 1: Identify Error Type

Determine if the issue relates to:

- Mapping

- Missing data

- Authentication

- System downtime

- Duplicate record

Step 2: Fix Mapping or Missing Data

Examples:

- Add missing tracking category

- Correct GL code

- Add tax type

- Update employee ID

Step 3: Retry Sync Automatically or Manually

iPaaS systems provide:

- Manual “retry” button

- Automatic retry queues

- Batch resync options

Step 4: Verify Posting

Check both systems to ensure:

- Journal posted correctly

- The invoice/bill shows correct amounts

- Employee or contact synced without duplicates

4. Reconciliation Process

Reconciliation ensures that records across both systems reflect identical financial values.

4.1. AR Reconciliation:

- Compare invoices in Xero vs NetSuite

- Ensure payments update both systems

- Validate customer balances

4.2. AP Reconciliation:

- Ensure bills appear in both systems

- Match vendor balances

- Verify payment status

4.3. Payroll Reconciliation:

- Confirm payroll journals imported correctly

- Validate tax, superannuation, and deductions

- Confirm employee cost allocation

4.4. Journal Entry Reconciliation:

- GL impact must match debit/credit totals in both systems

- Ensure correct department/location tracking

- Validate currency adjustments

5. Audit Trail: Full Traceability for Compliance

Auditability is essential for enterprise reporting, tax filings, and regulatory compliance.

What Audit Trails Capture:

- Every synced transaction

- User is responsible for creating/editing the record

- The exact fields changed

- Original source record ID

- Mapping applied

- Sync timestamp

- Approval history

Why It Matters:

- Ensures GL accuracy

- Supports internal audits

- Required for external statutory audits

- Helps defend against compliance violations

6. Sandbox Testing Before Deployment

Before integration goes live, sandbox testing is critical.

What to Test:

- Single invoice sync

- Batch invoice sync

- Payroll journal sync

- Bill imports

- Contact creation flow

- Error handling scenarios

- Duplicate prevention

- Payment mapping

Why It’s Necessary:

- Prevents data contamination

- Eliminates mapping errors early

- Helps validate custom workflows

7. Reconciliation Frequency Recommendations

To maintain maximum data accuracy:

- Daily reconciliation for high-volume organizations

- Twice weekly for moderate transaction flows

- Weekly for small subsidiaries

- End-of-month mandatory reconciliation for all

This ensures that both systems contain aligned, audit-ready financial data.

8. How iPaaS Improves Error Handling

iPaaS solutions provide:

- Real-time alerts

- Auto retries

- Granular logs

- Mapping exception panels

- Duplicate detection

- API throttling prevention

- Monitoring dashboards

This reduces operational overhead significantly.

9. Common Enterprise-Grade Troubleshooting Techniques

- Use unique IDs for employees/vendors/invoices.

- Build mapping tables for GL accounts & tracking categories.

- Sync smaller batches to reduce API load.

- Use “archive and replace” logic for duplicates.

- Lock posting periods only after confirming sync.

- Validate mapping after any chart-of-accounts update.

Best Practice Recommendations for NetSuite Xero Integration

The effectiveness of NetSuite Xero integration depends heavily on establishing disciplined operational practices, strong data governance, consistent mapping logic, and proactive error monitoring. These recommendations help organizations reduce sync failures, maintain audit accuracy, and ensure that financial data remains reliable across both systems.

Below are the most important enterprise-grade best practices.

1. Standardize and Document All Mapping Rules

The biggest cause of data mismatches is inconsistent or undocumented mapping.

Document the following mapping rules:

- Chart of accounts mapping

- Tracking category → department/location mapping

- Payroll component mapping (wages, allowances, superannuation)

- Tax code mapping (GST/VAT settings)

- Contact/customer/vendor mapping

- Employee unique identifier mapping

- Currency mapping

- Subsidiary/entity routing logic

Why This Matters:

- Reduces duplicate creation

- Supports better troubleshooting

- Prevents drift between systems

- Makes future updates transparent

Mapping documentation should be updated whenever:

- A new account is added

- A location is renamed

- Payroll rules change

- A new subsidiary is added

2. Keep Naming Conventions Consistent Across Both Systems

This best practice reduces sync errors significantly.

Examples:

- Keep account names and numbers identical (e.g., 4000 – Sales)

- Use consistent vendor/customer names

- Standardize employee email format (e.g., firstname.lastname@domain)

- Standardize item/SKU naming

Benefits:

- Prevents duplicates

- Reduces reconciliation complexity

- Makes reporting clean and aligned

This also improves the reliability of Xero NetSuite integration workflows that depend heavily on name-based matching.

3. Always Sync Approved Transactions Only

Avoid syncing drafts or unapproved bills, invoices, or journals.

Recommended:

- Only sync records that are fully approved in the source system.

- Lock draft items from being pushed downstream.

Why:

- Draft data introduces reconciliation errors

- Prevents accidental double-posting

- Keeps financial statements accurate

4. Audit Reconciliation Logs Regularly

Even with automation, manual oversight is required to maintain financial accuracy.

Audit frequency recommendations:

- Daily for large organizations

- Weekly for mid-sized teams

- Monthly minimum for smaller entities

What to review:

- Unmatched invoices/bills

- Failed sync items

- Missing tracking categories

- Duplicate contacts or vendors

- Payroll journal mismatches

- Tax code inconsistencies

This ensures no data discrepancies build up in downstream reports.

5. Prioritize Tracking Category and Location Mapping

Because Xero uses tracking categories instead of NetSuite’s departments/locations, mapping these correctly is essential.

Before enabling sync:

- Validate all tracking categories exist in Xero

- Map every NetSuite location/department

- Test several sample transactions

Why important:

Incorrect mapping results in:

- Incorrect cost allocation

- Misaligned budgets

- Faulty profitability reporting

- Duplicate category creation

6. Schedule Credential & Authentication Refresh Cycles

OAuth tokens in Xero and TBA tokens in NetSuite expire periodically.

Implement:

- Quarterly token renewal

- Automated token refresh logic (supported by iPaaS platforms)

- Alerts when a connection breaks

Why:

- Authentication failure is the #1 cause of sync interruptions

- Prevents sudden downtime

- Ensures near-perfect integration uptime

7. Use Batch Sync for High-Volume Operations

If your business processes thousands of invoices, bills, or payroll entries:

Use:

- Batch sync instead of real-time sync

- Off-peak scheduled runs

- Incremental sync logic

Why:

- Prevents API throttling

- Reduces iPaaS processing cost

- Stabilizes data flow

- Reduces the probability of duplication

8. Implement Data Validation Before Synced Records Leave Source System

A simple validation layer prevents 80% of common sync errors.

Validation Checklist:

- No missing mandatory fields

- Correct tax code applied

- Valid GL account mapped

- Date format matches the target system

- Duplicate email or vendor name detection

Where to implement:

- NetSuite SuiteScript

- iPaaS pre-processing filters

- Xero validation rules

9. Use Sandboxes & Test Environments for All Changes

Any change in the chart of accounts, payroll rules, or workflow automation must be tested in a sandbox first.

Test Scenarios:

- Journal entries

- Payroll runs

- Multi-currency invoices

- Vendor bill creation

- Contact creation

- Payment updates

Why:

- Prevents corruption of production data

- Avoids large-scale sync failures

- Ensures correct GL impact

10. Keep Both Systems “Clean” with Periodic Data Hygiene Audits

Data hygiene ensures long-term integration stability.

Audit for:

- Duplicate vendors/customers

- Inactive GL accounts

- Unused tracking categories

- Incorrect payroll categories

- Old API keys

- Redundant scripts or workflows

Outcome:

Financial data remains clean, consistent, and audit-ready.

KPIs and Value Realization from NetSuite Xero Integration

Enterprises adopting NetSuite Xero integration often aim to reduce manual work, speed up financial close, increase reporting accuracy, and eliminate errors across AR, AP, payroll, and GL operations. To evaluate whether the integration is truly delivering value, organizations must track specific KPIs tied to efficiency, data integrity, and operational performance.

This section outlines the most important KPIs, what they measure, and how they relate to financial outcomes.

1. Sync Latency (Event → Integrated Record Time)

What it measures:

The time taken for a transaction created in the source system to appear in the target system.

Expected benchmarks:

- Real-time sync: seconds to minutes

- Batch sync: hourly/daily

- High-volume enterprises: under 3 hours for full-cycle update

Why it matters:

- Faster month-end close

- Improved cash flow visibility

- Real-time reporting reliability

Tracking sync latency reveals whether system changes, increased volume, or authentication issues are slowing down financial operations.

2. Manual Entry Reduction (Efficiency Gains)

What it measures:

The amount of manual work was eliminated after integrating the systems.

How to measure:

- Count the number of invoices previously entered manually

- Measure time required for payroll journals pre-/post-integration

- Track hours spent per week on export/import tasks

Typical improvements:

- 70 - 90% reduction in manual entry

- 50 - 80% fewer human errors

- Up to 20 hours/week saved for finance teams

Why it matters:

Less manual input equates to fewer errors, better accuracy, and more time for strategic work.

3. Payroll Accuracy & On-Time Success Rate

Especially relevant for businesses syncing WFM/NetSuite timesheets with Xero Payroll.

What to track:

- Percentage of payroll processed without manual fixes

- Number of failed payroll exports

- Delays caused by missing/incorrect mappings

- Journal posting accuracy in NetSuite

Expected benchmarks:

- 95 - 100% payroll success rate with correct mapping

- <1% error rate due to missing staff IDs or invalid pay items

Why it matters:

Payroll errors affect compliance, employee satisfaction, and financial reporting.

4. Data Mismatch / Error Rate

What it measures:

The frequency of mismatches between systems after syncing data.

Examples of mismatches:

- Invoices appearing in Xero but not in NetSuite

- Unmapped tracking categories

- Duplicate vendors/customers

- Incorrect payroll journal allocation

- Failed tax mapping

Healthy benchmark:

- <3% error rate on active integrations

- <1% for mature, optimized setups

This KPI directly reflects the quality of mapping, validation, and governance practices.

5. Time-to-Close for Financial Period

What it measures:

The number of days required to complete the month-end or period-end reconciliation.

Expected improvements:

- 20 - 40% faster month-end close

- Fewer manual adjustments due to mapping standardization

- Automated journal sync reduces closing delays

Why it matters:

Faster closing cycles allow for quicker decision-making and better financial planning.

6. AR/AP Processing Time Improvements

KPIs to Track:

- Invoice creation-to-sync time

- Bill approval-to-sync time

- Payment update latency

- Number of invoices processed daily/weekly

Expected outcomes:

- AP processing time reduced by 30–60%

- AR reconciliation accelerated by 40–70%

Why it matters:

Improved cash visibility → better forecasting → stronger liquidity management.

7. Journal Posting Accuracy

What it measures:

The accuracy and completeness of journals are synced between systems.

Recommended KPIs:

- Percentage of journals posted without modification

- Number of rejected journals

- Duplicate journal entries detected

- Correct classification by department/location/tracking category

Expected outcome:

- <1% journal inaccuracies

- Zero duplicates in stable integrations

This KPI ensures data reliability for financial reporting and audit cycles.

8. Integration Uptime/Sync Success Rate

Measures the stability of the integration.

Track:

- Successful sync attempts

- Failed attempts

- API outages

- Middleware uptime

Benchmarks:

- 99.5%+ uptime via iPaaS

- 98%+ uptime for custom API integration

Why it matters:

Consistent uptime eliminates operational bottlenecks and avoids sync backlogs.

9. Duplicate Detection Rate

What it measures:

The number of duplicate vendors, customers, employees, invoices, or journals created by sync operations.

Goal:

- 0 duplicate records in production

- Real-time duplicate blocking rules in place

Why it matters:

Duplicate records lead to major reconciliation issues and incorrect financial reports.

10. Real-Time Cash Position Accuracy

For companies syncing payments and journals:

Track accuracy of:

- Cash balances

- AR aging

- AP obligations

- Bank feed reconciliation

Accurate sync ensures the finance team has a real-time view of liquidity.

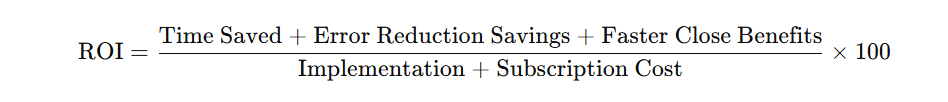

11. Integration ROI

After implementation, calculate ROI:

Formula:

Typical Enterprise ROI:

- 3 - 7X in the first 12 months

- Higher for multi-entity organizations

Conclusion

Implementing a strong, scalable NetSuite Xero integration is no longer a convenience — it is a strategic necessity for enterprises operating across multiple regions, using different accounting workflows, or managing high-volume financial operations. By unifying the power of NetSuite’s ERP capabilities with Xero’s user-friendly accounting and payroll ecosystem, businesses eliminate inefficiencies, reduce errors, and achieve greater financial visibility.

This integration empowers finance teams with:

- Seamless multi-entity consolidation

- Accurate and automated payroll journals

- Reliable AR/AP synchronization

- Real-time reporting across systems

- Error-free reconciliation and audit readiness

- Faster month-end close cycles

- Centralized financial intelligence

Whether your goal is to streamline payroll, connect regional Xero entities with your global NetSuite ERP, or automate accounting workflows using powerful iPaaS platforms, this integration delivers tangible value. It transforms fragmented processes into a unified, automated financial engine, one that supports scalability, compliance, and long-term operational excellence.

As organizations increasingly face complex financial structures, international tax obligations, and distributed teams, a well-planned integration ensures the finance function remains agile, accurate, and future-ready. In short, businesses that integrate now position themselves far ahead of those that still rely on manual processes and disconnected systems.